The Regional Economy in 2025

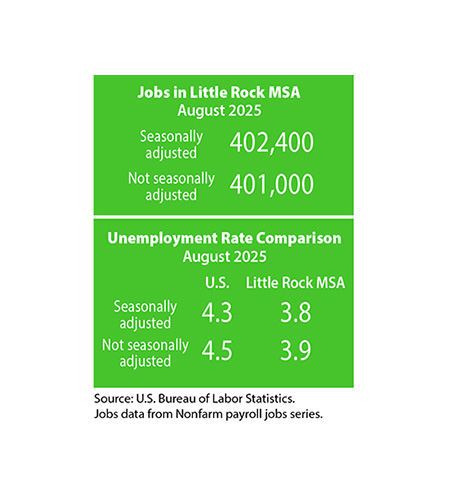

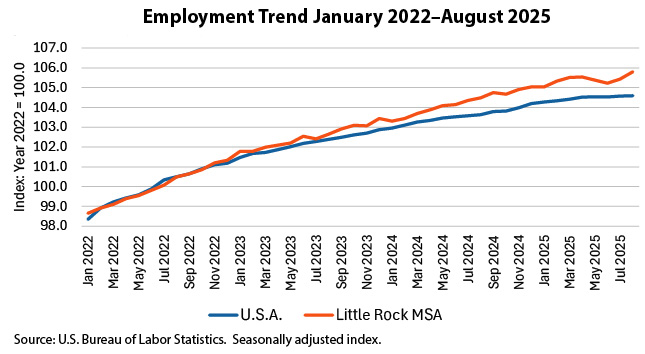

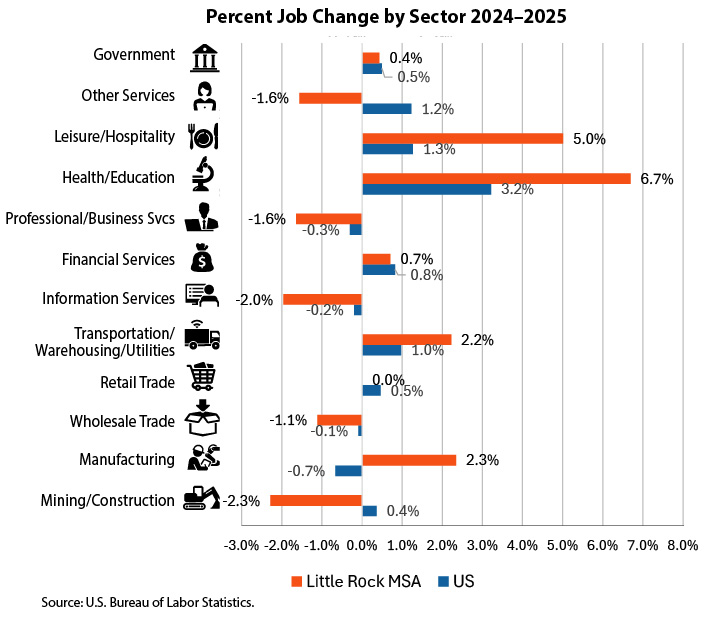

Central Arkansas continues with its track record for steady growth. Job growth has slowed since 2022 but remains above the U.S. average for the 2022–2025 period. In August 2025 the region hosted 402,000 jobs, with a growth rate of 1.3 percent compared with August 2024. U.S. job growth was 0.9 percent over the same interval.

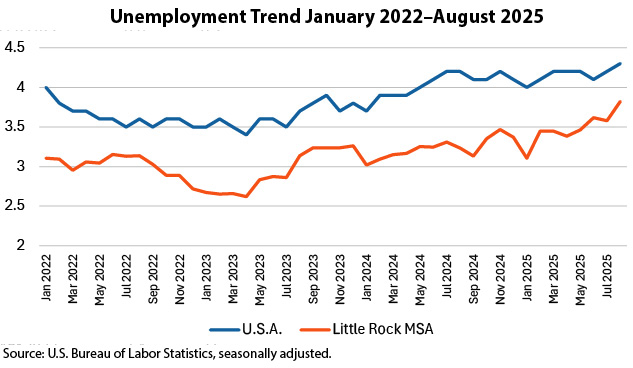

Unemployment has ticked up, but only slightly, from a post-pandemic low around 2.6 percent locally to around 3.8 percent in August 2025. This remains a bit lower than the 4.3 percent U.S. average.

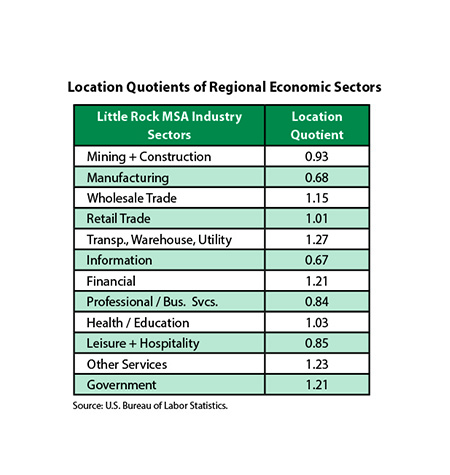

The table at left conveys Location Quotient (LQ) of regional economic sectors, in comparison with the U.S. average. Any LQ score above 1.0 suggests greater-than-average emphasis, while sectors with scores below 1 are smaller than the U.S. average. You can quickly see the region’s highest score is in the Transportation, Warehouse and Utility sectors. It is also above average in the closely related Wholesale Trade sector.

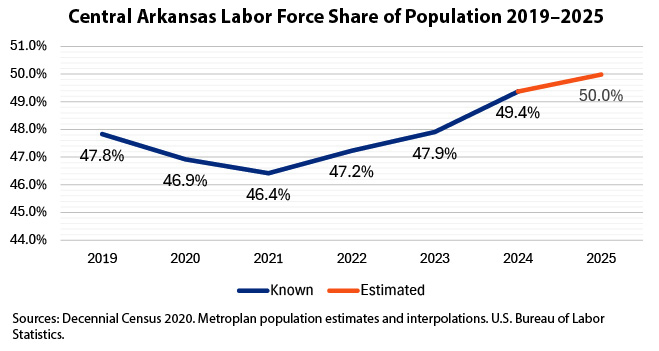

The region continues to develop its role in logistics and transportation. Major shifts in the international trading order have fed recent demand for logistical and warehousing services, and the local area has responded with shovel-ready site availability and a quick approval process. Local labor force participation continues growing, reaching 50 percent of population in 2025. The labor force matched its 2019 pre-Covid peak by 2023 but has continued making gains as a share of population. While low local unemployment rates could suggest a labor shortage, participation growth suggests ambitious firms can find a growing supply of willing workers.

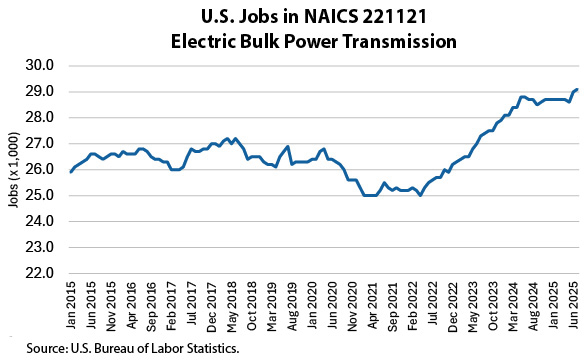

Central Arkansas plays a prominent role in a business sector that gets little public attention: power grid management. Recent data analysis has revealed that the region holds about 6 percent of all U.S. jobs in NAICS category 221121, “Bulk Electric Power Transmission.” Two firms, MISO and the Southwest Power Pool, dominate this local sector, with about 1,750 jobs by the most recent count. This amounts to a local LQ of over 25.0—probably the highest in the regional economy, and hence a major economic driving force. This important sector has seen substantial national job growth since about 2022. This growth has been driven by demand growth (data centers) and the need to improve transmission response for outages related to extreme weather.

Energy demand has been a prominent news issue lately, with growing concerns about constrained electricity supply. Whether the problem stems from growing power demand from data centers, crypto-mining, automation-related electrification of machinery and tools, or general economic growth, customer bills are showing the strain. Over the short term, there is a looming anxiety about electric power shortage.

Despite today’s electricity market pressures—or because of them—a revolution is underway in renewable energy that has the potential to transform shortfall into abundance. Solar is already one of the lowest-cost energy sources, and performance continues improving. This edition of the Metrotrends Economic Review and Outlook will describe this unexpected energy metamorphosis.

Economic Outlook 2026

1 “How Markets Could Topple the Global Economy,” Economist November 13, 2025.

2 “Geothermal’s Time Has Finally Come,” Economist November 18, 2025.

The regional economic engine continues ticking over smoothly and delivering steady growth. Demographic factors present a labor shortage challenge but so far business startups and expansions in the region have always managed to draw in workers and thrive, demonstrated by a steady rise in regional labor force participation since 2021.

The local manufacturing outlook is strong, benefiting from national economic policy and local competitive advantages. The Port of Little Rock is seeing promising and sizeable investments from firms like Welspun (steel pipe manufacturing), Elopak (sustainable food containers), and Amazon. Infrastructure improvements and transportation planning efforts are priming the area for a “Super Site” with region-wide economic benefits.

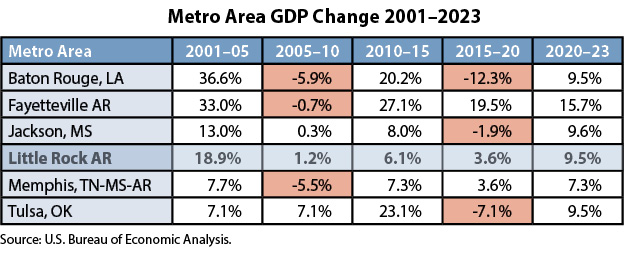

The national economy faces risks that the AI boom, coupled with a surge in under-regulated “creative financing,” could yield an investment market correction.1 Productivity gains from AI might defy these obstacles, powering through with little disruption. In any case, the regional economy looks sound. The table at right compares Central Arkansas GDP performance against other U.S. South Central metros from 2001 to 2023. As you can see, Central Arkansas was the only one that delivered positive growth in every interval.

Central Arkansas is a major player in power transmission, benefiting from centrality and low local energy costs. Shifting federal policies will barely slow the upward-sloping curve in renewable energy, which is undergoing an exponential trend. While solar energy is limited by seasonal and weather-related factors, electricity demand peaks during the same summer months that solar output maximizes.

Geothermal energy is now benefitting from recent technological advances in drilling and fracking for fossil fuels.2 Once tightly restricted by location, it will soon become feasible in a far wider range of sites.

Energy demand is strong, and getting stronger, causing price pressures and disruptions in the short term. Technological advances in renewable energy are altering the cost equation, and power providers will adapt. We are seeing a transformation in energy abundance that will change the economy as we know it.

Moving Cargo Efficiently at LSI

Logistic Services, Inc. (LSI) uses cranes to lift cargoes from barges and trains onto trucks, a small but indispensable part of operations at the Port of Little Rock. LSI participates in a 2024 Sustainability Plan sponsored by its corporate owners, reducing emissions while improving productivity. Its new Manitowoc crane—built in the U.S.A.— operates with about 60 percent less diesel fuel, on an hourly basis, than the crane it replaced. In 2026, another crane will be retired and a more efficient one added. LSI’s new systems include a link belt material handler that yields 35 to 40 percent lower carbon emissions, while moving materials faster than the former machine. LSI also emphasizes dust mitigation with bulk products, reducing emissions while also cutting down on wastage. LSI manages a wide variety of products, including steel and aluminum coils, fertilizer, petcoke, wetcake, and bauxite.

LSI is also in the warehousing business, a growing market segment in today’s trading environment. It offers bonded warehouses, meaning self-contained storage space giving customers the same advantages as a foreign trade zone, but on a more economical scale.

Carrix, LSI’s parent company, is the world’s largest privately-held marine and rail terminal operator. It manages over 250 locations on five continents.1

1portoflittlerock.com/2024/01/logistics-services-inc-the-port-of-little-rocks-stevedoring-partner/

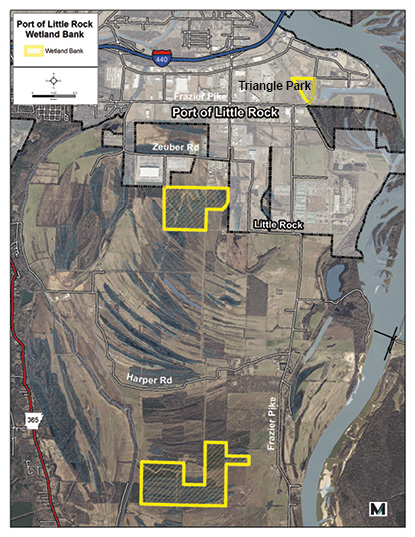

Triangle Park and Wetlands at The Port

It doesn’t look like much right now, but the Port of Little Rock is working with the Audubon Society and Applied Land Restoration (ALR) to convert 29 acres of former soybean fields into a wetland nature preserve. It will become a birding habitat featuring native trees and plants, with an emphasis on pollinator species. A boardwalk will allow the visiting public to cross the wetland on foot, bike or wheelchair, enjoying the colors, as well as the tweets, chirps, and croaks of nature. Wetlands are rich and vital natural habitats, also filtering and improving water quality while reducing flooding problems nearby.

By adding the Triangle Park to the Fourche Bayou Mitigation Bank, stream and wetland offset credits will be sold to private developers permitting building sites elsewhere within the port. Over coming years, the Port of Little Rock intends to develop three additional wetland sites, tallying up to 500 additional acres. Since the Port’s land area includes sizeable wetland areas, having 500+ acres of stream and wetland credits on offer will make it easier for firms to move in and develop their sites for manufacturing and warehousing, with economic benefits for the entire Central Arkansas region.

At left: Property dedicated to Fourche Bayou Mitigation Bank.

Amazon Uncertainty

As this edition reached the brink of publication, we learned that Amazon has announced “an indefinite closure of its Port of Little Rock fulfillment center,” with the loss/relocation of about 4,600 jobs.1 The fulfillment center, which requires “structural repairs,” will reopen at a future date. In the meantime, Amazon is currently constructing its “LIT 3 cross-dock facility,” with a forecast opening date in 2027.

1 “Ex-employees of Amazon hit LR job market,” Arkansas Democrat-Gazette, Saturday 22 November 2025.