Housing Construction

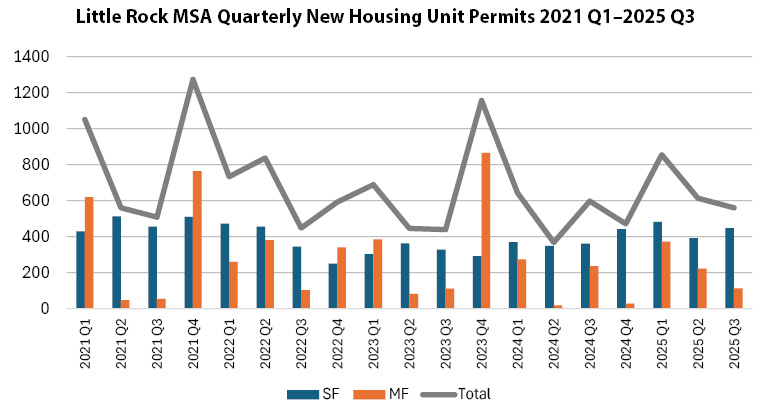

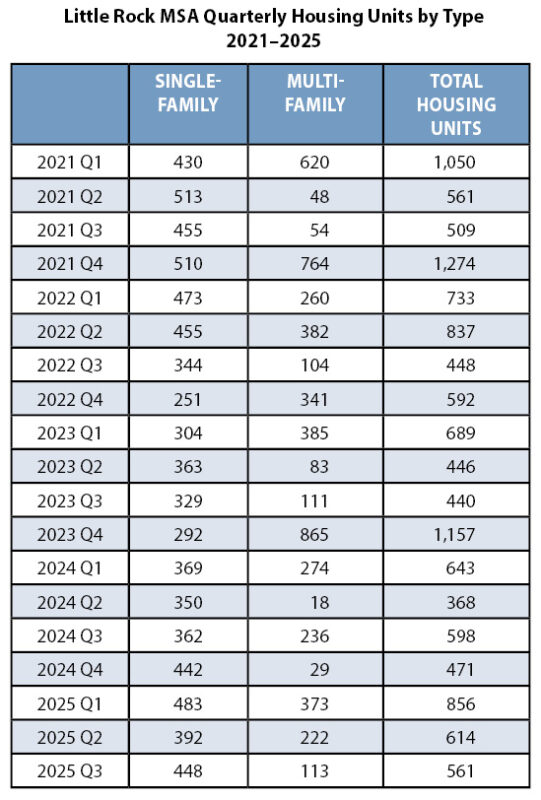

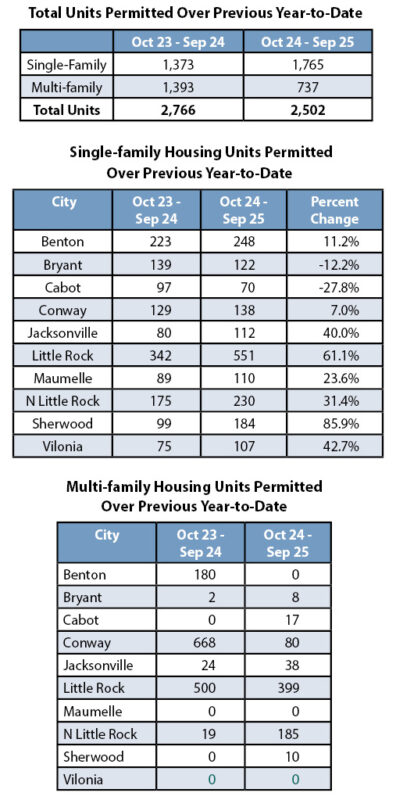

Regional housing construction is making steady progress. Single-family construction rose about 29 percent over the past year, while multi-family was down 47 percent. Total new housing units were down slightly compared with the previous year. The chart below shows the quarterly trend. As usual, single-family has churned along steadily in recent years while multi-family construction has more up-and-down bounce to it.

Most cities in the region made gains in single-family construction over the past year. Sherwood saw an 86 percent gain, Little Rock rose 61 percent, and Vilonia climbed 43 percent. Only Bryant and Cabot saw fewer new homes built, compared with the previous year.

Multi-family construction remains focused in the region’s largest cities, with Little Rock, Conway and North Little Rock leading the pack. In multi-family most cities were down, although North Little Rock saw a big jump mainly boosted by more units at the Pointe North Hills in Lakewood. Little Rock is seeing multi-family growth in its southwest region.

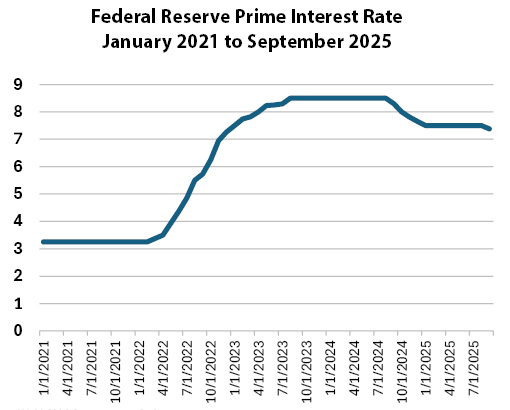

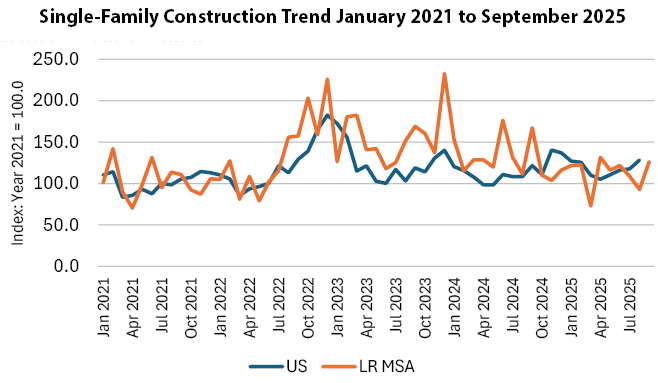

Single-family housing in the area ran a bit above the national trend in 2023 and 2024. Although the local trend sees upward and downward ticks, it is tracking the national average and will respond positively to a decline in the Federal Reserve’s prime rate in the summer of 2025.

Construction Value

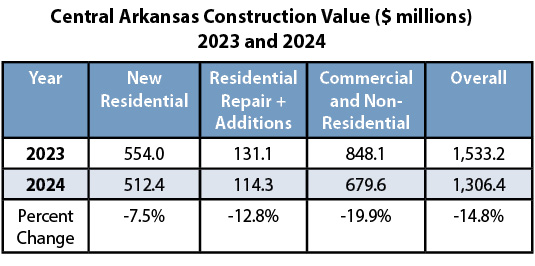

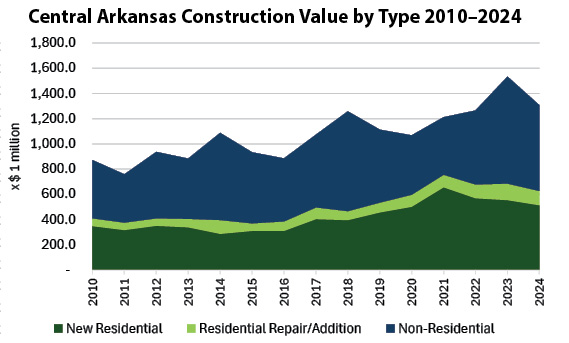

Regional construction value receded by about 14 percent in 2024 compared with the previous year. This reflects a moderate economic slowdown due to high interest rates. The region nonetheless saw $1.3 billion in new construction. Residential construction only dropped by 7.6 percent, reflecting continued demand for new housing in a growing regional economy.

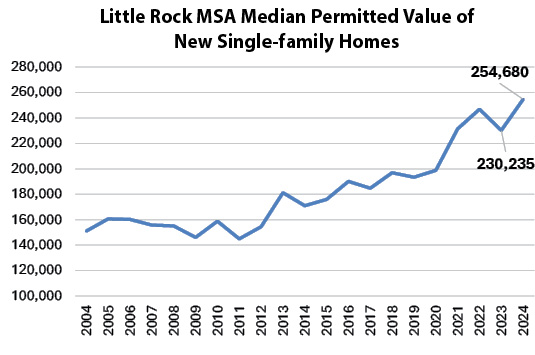

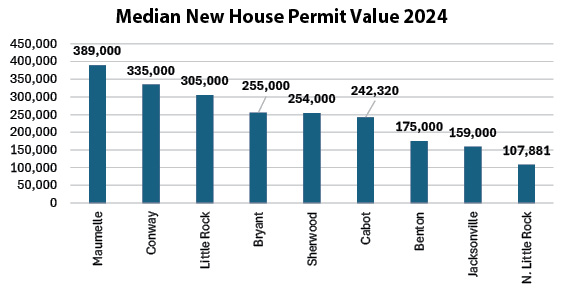

The median value for new homes climbed to $254,680. As always, this is the median value calculated from building permit records; market observation suggests the initial selling price for homes is roughly double the stated permit value. The chart at right depicts new homes by stated value. Maumelle was highest at $389,000, followed by Conway ($335,000) and Little Rock ($305,000). The lowest values – at the permit stage – were found in North Little Rock at $107,881, and Jacksonville at $159,000. These figures reflect local conditions and permitting procedures, sale values run higher and may follow a differing pattern.