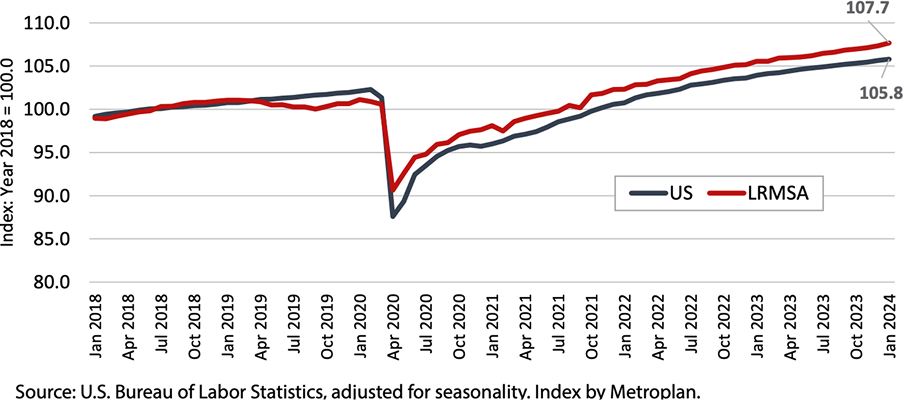

Little Rock Regional Area Sees Steady Job Growth

The Little Rock regional area continues a pattern of slow but steady growth. By January of 2024, the region had 390,600 jobs, up 1.6 percent from 384,100 jobs a year previously. This was just a shade under U.S. job growth of 1.8 percent during the same interval.

Unemployment in the region hit record lows during 2023, at just 2.3 percent in April. In January, seasonally adjusted local unemployment was up a bit to 2.9 percent. This was still a shade lower than the U.S. rate of 3.7 percent. Although interest rates hit recent record highs during early 2023, economists have been surprised at the resilience the U.S. economy has shown in face of higher interest rates. Labor remains in short supply locally and nationally.

Metro City Market Capitalization (as of April 10, 2025)

5.9b

Consultant to 85 of the Fortune Global 100 companies

90/100

Consultant to 75 of the leading 100 private equity firms

71/100

Total Market Value (as of April 30, 2025)

2.4b

Job Trend January 2018–January 2024

While the overall regional economy has grown steadily, its component sectors are more complex. The chart below shows job growth or decline in the four sectors which saw the most change in the past year.

- The gain of 3,400 jobs suggests growth in the region’s health industry, boosted by a resumption of routine medical screenings post-pandemic.

- Return to normal post-Covid-19 probably helps explain growth in leisure and hospitality.

- The growth in construction and mining jobs (mostly construction) probably reflects highway construction along the I-30 corridor, as well as commercial construction activity.

- The loss of 1,800 jobs in retail trade may reflect post-pandemic adjustments, with a reduction in the federal stimulus money that boosted retail demand in the 2020-2022 interval.

- Regional retail sales have been relatively steady however, so the loss of jobs may reflect labor shortage—employers simply cannot find enough workers to fill retail jobs.

While the overall regional economy has grown steadily, its component sectors are more complex. The chart below shows job growth or decline in the four sectors which saw the most change in the past year.

Retail sales were up 3.2 percent in 2023, compared with the previous year. Total sales were $19.2 billion, slightly higher than $18.6 billion in 2022.3 The long-term trend suggests that, from 2019 to 2023, retail sales gains averaged about 4.4 percent per year in real (inflation-adjusted) figures.

- The chart below describes growth in GDP and population from 2017 through 2022, not just for the Little Rock MSA, but also for several nearby metro areas of similar size.

- With the blue bars depicting GDP gains it is hard to miss the tremendous economic growth which has occurred in the Northwest Arkansas region.

- But note that the Little Rock region registers second among the six south-central metro areas measured.

- The red bars give an estimate for population change, in which the Little Rock region came in third. Its ratio of economic-to-population growth demonstrates better-than-average economic gains in the past five years within the larger south-central region.

Retail sales were up 3.2 percent in 2023, compared with the previous year. Total sales were $19.2 billion, slightly higher than $18.6 billion in 2022.3 The long-term trend suggests that, from 2019 to 2023, retail sales gains averaged about 4.4 percent per year in real (inflation-adjusted) figures.

Property Values in Little Rock

Central Arkansas housing remains substantially more affordable than the U.S. average. The chart below compares monthly mortgage costs for homeowners. As you can see, Central Arkansas residents with a mortgage paid about $1,282 in housing costs in 2022, or 28 percent less than the U.S. average of $1,775. While local incomes are lower than the U.S. urban average, the cost/income differential still favors local residents. In a time of high interest rates, Little Rock region homes are more affordable.

Summing Up

Many experts had forecast a recession during 2023 due to interest rate hikes, because past rate hikes on a similar scale had generally caused recession. Looking into 2024, rates remain high while inflation is down but not gone. After peaking near 9 percent in mid-2022, inflation has generally run a little over 3 percent since the middle of 2023. The Federal Reserve has aired the possibility of two or three rate reductions later in 2024, citing a recent drop in “core” inflation, and anticipating further reduction toward the goal of 2.0 percent. While interest rates are likely to decline by late 2024, they will probably not return to the really low levels seen during the 2010 decade.