LONG-RANGE METROPOLITAN TRANSPORTATION PLAN

Chapter 4 of Transforming Mobility explains where our money comes from, what trends may impact our budget, how we identify and develop transportation projects, and how we track the performance of our infrastructure. With these factors in mind, the chapter also contains a project list of planned investments that fit within the confines of our currently identified funding for the next 20 years.

As a result of § 11201; 23 U.S.C. 134 the Bipartisan Infrastructure Law (BIL), the Metropolitan Planning Program continues to guide MPOs’ investments through a cooperative continuous and comprehensive framework. Chapter 4 of Central Arkansas Transforming Mobility is the region’s mandated Long-Range Metropolitan Transportation Plan (MTP) to the year 2050.

This MTP launches the region’s policy implementation with specific projects, actions, and other recommendations. The Plan’s biggest priority is maintaining the current transportation system (also a listed priority of Metroplan Transportation Partners ARDOT and Rock Region METRO). As financial needs far exceed projected revenues, the plan assigns 70% of Federal funding towards maintenance activities.

The plan favors mitigating roadway capacity needs by increasing investment in efficient multimodal options and rethinking land development practices.

PROJECT DEVELOPMENT

The core policies described in Chapter 3 aim to meet future transportation demand with balance that includes an efficient freeway system, a strategic regional arterial network, a complete Regional Greenways system, expanded regional and local transit, and more walkable and bikeable communities, all maintained in a good state of repair.

An incremental approach over the plan’s horizon will include impactful standalone projects that are programed into Metroplan’s Transportation Improvement Program, a document that develops from infrastructure needs of our partners.

Roadway Projects

Vehicles, for personal use, freight, and transit, are the primary transportation mode in Central Arkansas. The MTP aims for freeways and a Regional Arterial Network that are in good repair, safe, and efficient. Projects for roads are categorized as maintenance, operational improvements, widening, and new facilities.

Maintenance

Maintenance will take priority in project development to prevent premature infrastructure decline and aid financial constraint. Maintenance is classified as either “Routine,” “Major Rehabilitation and Repair,” or “Bridge Replacement.”

Routine tasks include maintaining joints, minor roadway repairs, traffic signal repair, lane striping, signs, and mowing, and will be short term in nature. Routine maintenance is covered under the agency’s general budget and often performed by staff.

Rehabilitation is a more substantial project often performed every 10-20 years. This may consist of replacing or overlaying pavement or a complete reconstruction where additional degrading has occurred. Updates to pedestrian or bicycle infrastructure may be included in rehabilitation projects. ARDOT Rehabilitation projects are performed consistent with the Transportation Asset Management Plan and are usually listed in the TIP. See 2022-TAMP (ardot.gov).

Bridges are rated as in good, fair, or poor condition based upon their substructure and decking, with the lowest ranking reflecting the bridge conditions. Bridges that are in poor condition or do not meet current standards require major rehabilitation or should be replaced. Bridges in fair condition will require extensive maintenance or replacement during the plan period. Recent analysis shows that 3% (or 7% of the deck area) of the region’s more than 1,350 bridges are rated in poor condition and 44% (or 53% of the deck area) is rated in fair condition (see Appendix 6).

More than 1,350 bridges in the region:

3% are in poor condition.

44% are in fair condition.

Operational Improvements

Operational improvements increase safety and efficiency on existing infrastructure. These improvements can be made to roadway corridors by adding turn lanes, improving signage, or with intelligent transportation systems that coordinate traffic lights or alert users to roadway conditions. In some cases, reallocating space with road diets may improve conditions for all users.

Rail grade separation projects minimize conflicts between railways and travelers by physically separating the crossing with an overpass or underpass. On key corridors, these separations minimize delays caused by passing trains and help reduce the potential for serious accidents with roadway users.

Intersections and interchanges can also be optimized to improve a corridor. Technology at traffic lights can sense when cars are queuing and change the light based on need. Emergency vehicles can also trigger sensors to traverse an intersection safely and quickly. Also, clear pavement markings and directional signage are low-tech fixes that enhance user awareness resulting in improved operations. Interchanges are similar and the addition of turn lanes, new ramps, or signal modifications can improve traffic operations.

Active Transportation Projects

Transforming Mobility focuses on expanding Central Arkansas’ transportation options for all user types. In Chapters 2 and 3, the plan explains land development patterns and its influence on personal mobility. However, this is only half of the equation as infrastructure must be in place to accommodate active modes like pedestrians, bike riders, transit riders, and micromobility users.

Central Arkansas has gradually added miles of sidewalks, bike lanes, and multi-use trails to its transportation profile. These investments must continue as corridors are reconstructed and new roadways meet enhanced requirements.

Widening and New Roadways

Where additional travel lane capacity is needed, widening of freeways and arterials may be considered to address recurring congestion. Technology changes may also impact capacity needs in the long-term; therefore, widening projects are largely based on current needs. Widening projects are often conducted in association with major rehabilitation projects.

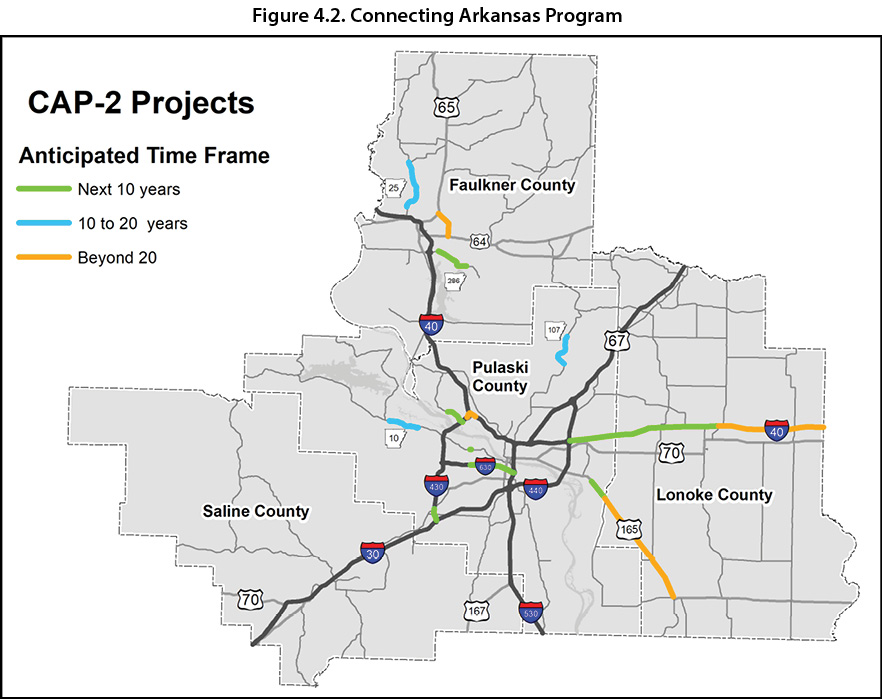

ARDOT has identified several widening projects as part of the Connecting Arkansas Program Phase II. This program is proposed to add travel lanes or address interchange congestion along several freeways and major arterials within Central Arkansas. These projects are shown in figure 4.2. with an estimated time for their completion.

New roads may relieve congestion on an existing facility, strengthen the road network or provide better connections between destinations. New facilities are constructed as partnering projects with substantial local contributions.

Local Infrastructure

Like many of the region’s city regulations, Metroplan prioritizes projects with multimodal accommodations with its funding, ensuring consistency between our partnerships. Investment in active transportation expands mobility to additional transportation modes, and is a cost effective way to accommodate travelers.

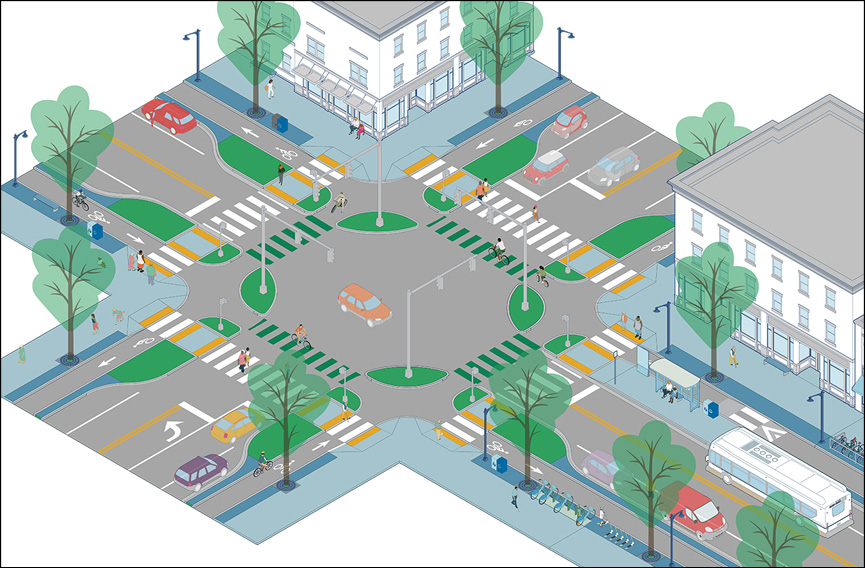

Metroplan’s Multimodal Infrastructure Guidelines (Appendix 3) recommends treatments to fit every corridor, including at intersections. The guidelines can help our cities invest in the best accommodations based on the environment they want to create for a given corridor. Beyond just arterial, collector, or local street classifications, the guidelines recognize that infrastructure looks different in a downtown area versus a neighborhood in the suburbs, regardless of similar street classification.

The guidelines can inform decisions for efficient investments by providing detailed specifications for everything from sidewalk width to bike lane location, and even curbside management for delivery vehicles, scooters, and transit stops. Underbuilding or overbuilding for active modes can cost a city resources and goodwill from its public. Appropriately scaled projects fit the context of the environment and make better use of public funds.

The Transportation Alternatives Program is the primary federal fund source used to support local active transportation projects.

Regional Infrastructure

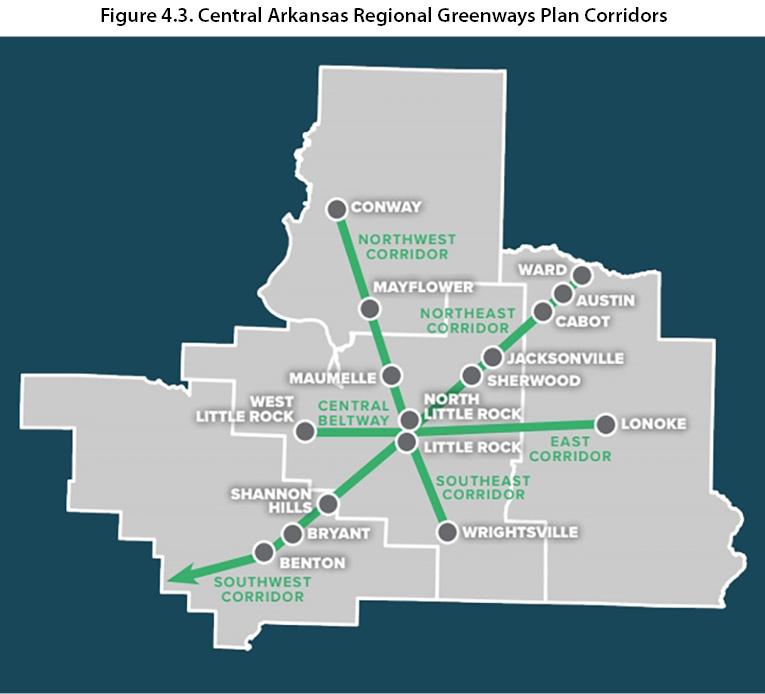

Metroplan adopted the Central Arkansas Regional Greenways Plan (Appendix 4) in May 2023 to guide a portion of its funding allocation to trail design and construction. A strategic target of $55 million over ten years will be spent on the system. The Arkansas River Trail and six planned corridors of largely off-road active transportation paths, supplemented by bike lanes on retrofitted streets, stretch over 222.3 miles across all four counties in the study area.

- Central Beltway—Connects Downtown Little Rock to West Little Rock through the central city.

- Northwest Corridor—Connects Little Rock, North Little Rock, Maumelle, Mayflower, and Conway.

- Northeast Corridor—Connects Little Rock, North Little Rock, Sherwood, Jacksonville, Cabot, Austin, and Ward.

- East Corridor—Connects North Little Rock to Lonoke.

- Southeast Corridor—Connects Little Rock to Wrightsville.

- Southwest Corridor—Connects Little Rock, Shannon Hills, Bryant, Benton, to Garland County.

The Greenways Plan identifies the alignment, trail type, and amenities for each of these corridors. These alignments may be modified during the design process. To assist with implementation, each corridor is prioritized based on five-to-seven-mile segments that are then grouped into three tiers. Scoring criteria highlight four categories: Destinations, Connectivity, Constructability and Maintenance, Trail Access. These criteria measure destination density, links between other trails and transit, how easy segments are to construct and maintain, population density around trails, and access for vulnerable populations.

Metroplan will use a combination of Carbon Reduction Program Funding (CRP) and Surface Transportation Block Grant (STBG) to fund the greenways. Off-system trails and local connections to the Regional Greenways will be funded primarily through the Transportation Alternatives Program (TAP) and in conjunction with street improvement projects where applicable.

Active Transportation Maintenance

With any new infrastructure, maintenance must be considered. Off-road facilities, such as sidewalks and local trails, are the responsibility of the local agency. Similarly, on-road infrastructure will be planned into local budgets as part of roadway maintenance.

For the Regional Greenways, the local jurisdiction agrees to make the facility open and available for use by the general public, and to be maintained for the life of the project. TAP funds may be used to supplement maintenance activities on these projects.

are the responsibility of local jurisdictions.

transportation and recreation.

Transit Projects

Central Arkansas is heavily car-dependent, with over 90 percent of commuters opting for personal vehicles and only around 0.3 percent utilizing public transit for their trip to work. However, more than 1.5 million rides are made with transit in Central Arkansas every year. Central Arkansas residents rely on transit every day to get to work, school, health care, and to a variety of daily needs. Investing in more public transit provides residents and visitors with greater access and choice of transportation, which connects people to homes, jobs, health care, education, and daily life activities. It also helps mitigate congestion and improve air quality.

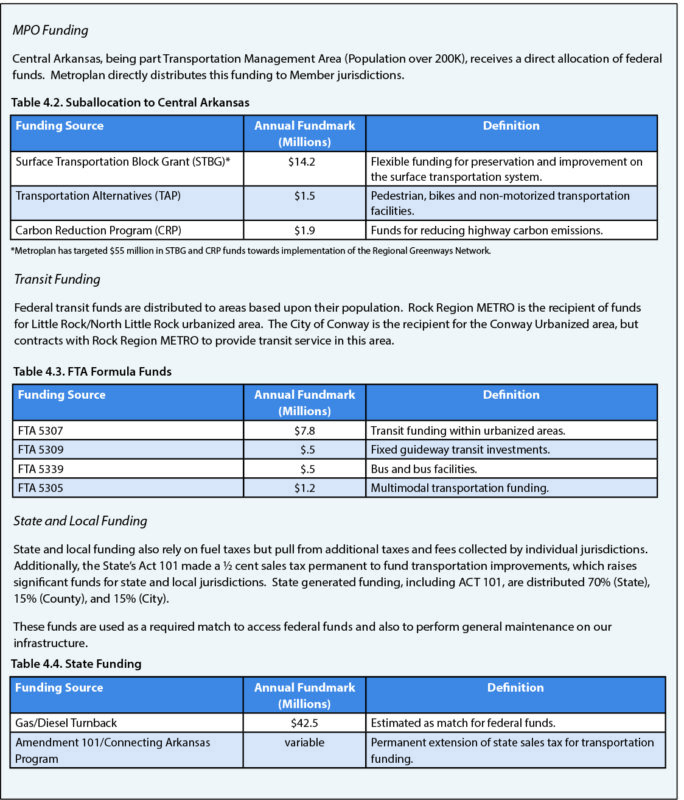

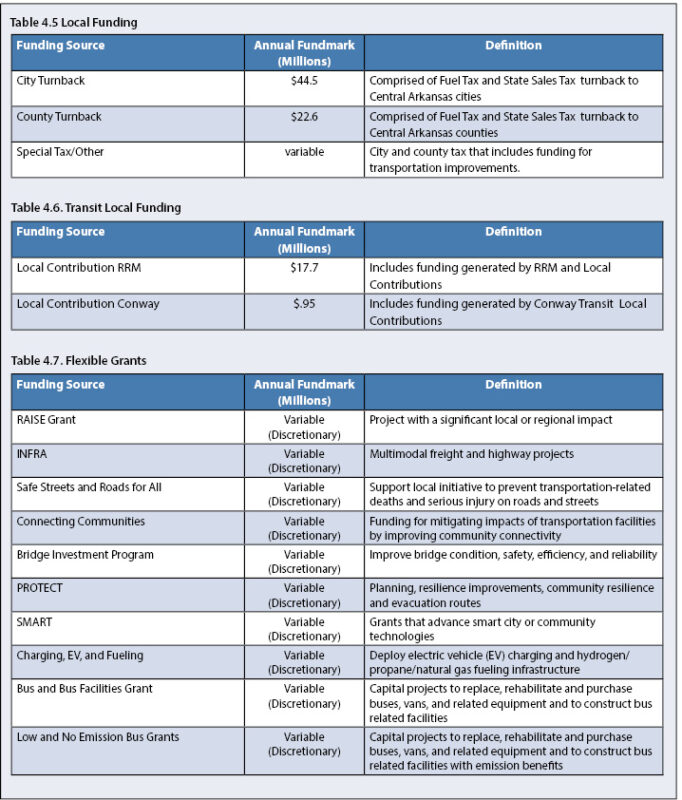

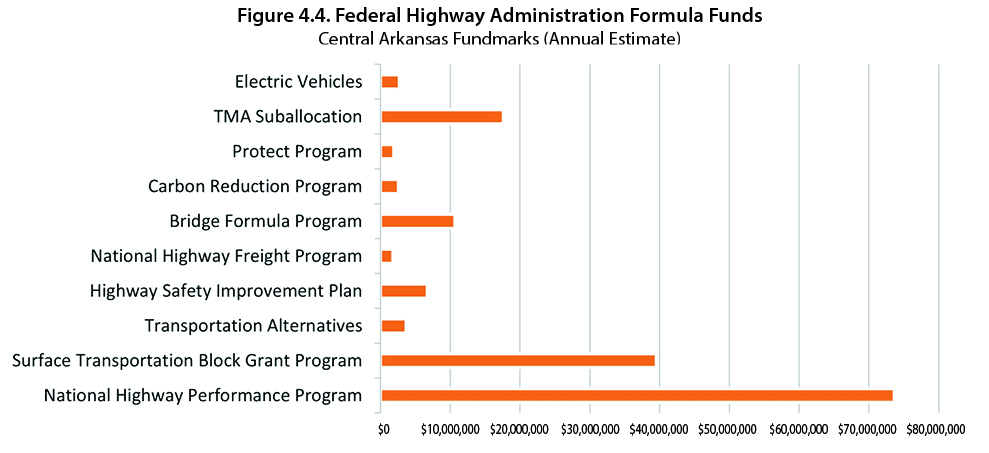

Budgeting uncertainty makes long-range transit planning and service expansion difficult. Transit funding in Central Arkansas is accounted for in the MTP and the 4-year TIP to guide project development. The MTP highlights transit funding from Federal, State, and Metroplan funds but Rock Region METRO, the region’s primary transit provider, receives the largest share of its funding from the local jurisdictions where it operates.

Little Rock, North Little Rock and Pulaski County supply funds through each jurisdiction’s annual operating budget. Federal funding is the second largest funding source for METRO, followed by direct funding, principally fare revenue, and roughly $610,000 annually from the State of Arkansas via the Public Transit Trust Fund. Rock Region’s total 2023 operating budget is $22.7 million. Local communities support transit through a funding contribution formula. Each jurisdiction must reauthorize this allocation in their budgets every year. The agency receives no dedicated tax funding, such as earmarked local sales tax revenue or property tax revenue.

As the designated recipient of federal public transit funds for the Little Rock Urbanized Area, METRO manages the bulk of transit financial transactions, revenues and expenditures in the CARTS region. The organization works with Metroplan to ensure its transit projects satisfy the total fiscal constraint for all projects in the MTP. Metroplan will continue to work with METRO, ARDOT, and local partners to coordinate transit project funding and reporting over the plan’s horizon.

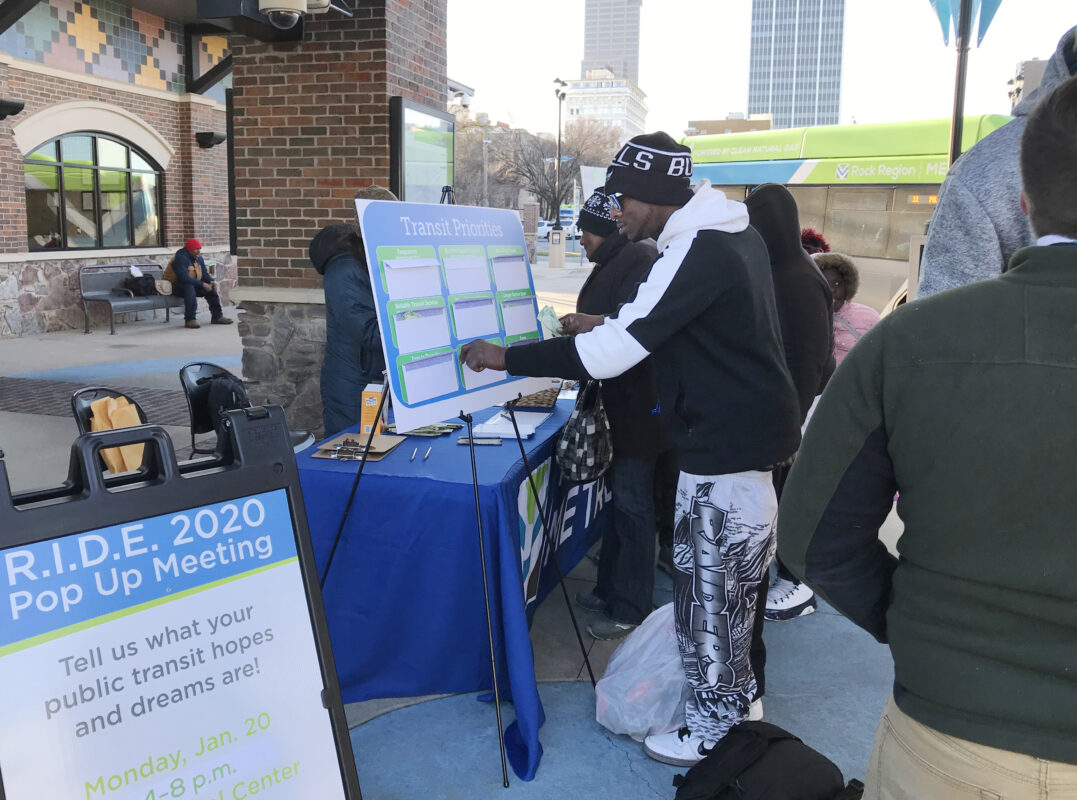

Regional priorities for transit include:

- First: Maintaining the current system and optimizing services

- Second: Improving frequency, expanding service hours and other strategic expansion

- Third: Expanded service area for regional transit

Maintaining the system

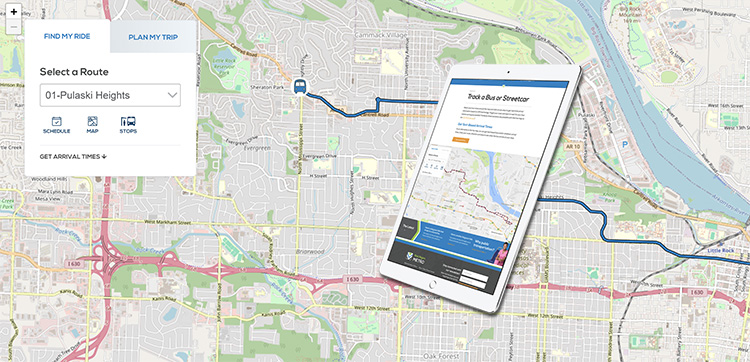

METRO currently operates one streetcar line, 15 fixed routes, and five on-demand microtransit zones in Little Rock and North Little Rock, and one microtransit zone in Conway. The fixed routes traverse the Little Rock and North Little Rock neighborhoods closest to the downtown core and offer a predictable schedule using mainly arterial roads throughout the metro area. Most routes offer a four-block-or-less walk to a transit stop from areas served.

For riders who have disabilities that prevent them from using the fixed route service, METRO offers door-to-door paratransit service up to three-quarters of a mile from fixed route transit stops. In 2019, they introduced microtransit service. In Pulaski County, it has been deployed to provide public transit service in areas of low transit demand, freeing up 35-foot mass transit buses for areas of higher transit demand. This has initially created some cost savings to expand overall network service, but future demand may dictate its long-term success.

Other Maintenance Considerations

A nationwide shortage of smaller public transit vehicles used for microtransit service has impacted METRO’s ability to meet demand for its microtransit service. Other factors, like a nationwide shortage of fixed route operators with commercial driver’s licenses, compounding amid the largest influx of federal funding for public transit in history through the Bipartisan Infrastructure Law, are causing U.S. public transit agencies to seek immediate solutions to this vehicle shortage as Americans return to work and post-pandemic economic activity moves forward.

Optimize Existing Service

Pursue dedicated funding with community support.

Dedicated long-term funding to accommodate annual inflation and broaden long-range planning efforts would allow METRO to provide longer service hours and better frequencies. This means that bus routes and microtransit zones could operate earlier in the day and later at night. However, service improvements require significantly more investment in labor, fuel and vehicles, as well as fixed expenses to support the overall operation, which necessitates new guaranteed, long-term financial investment. Securing funding is more possible with vocal, public support.

Update technology

Investments in technology provide real time information to bus riders and schedule adjustments. Advanced systems can coordinate traffic signals with arriving buses to improve efficiency and route reliability.

Opportunities for Transit Growth & Advancement

Transit operations in Central Arkansas have managed to outperform despite budget constraints, even during the COVID-19 pandemic. Leadership will continue to make the decisions necessary to remain consistent within their existing service. However, expanding service will require additional resources that are not currently part of the Fiscally Constrained Plan.

Private partnerships and funds could be pursued to subsidize service. Major employment centers generate demand and benefit greatly from access to transit. Interested businesses need transit past their current hours of operation, such as hospitals, retailers, or restaurants. Cities, businesses, large clusters of employment, economic developers, and transit providers could enter into a partnership for feasibility studies to determine if there is potential to alter service to meet this demand.

Although private partnerships have long been desired, ultimately the ability of private companies to spend large amounts of capital on transit is limited. Communities must determine how to dedicate new funding so that transit can increase its frequency and operational hours. These improvements can enhance the system’s reliability and raise the confidence of potential riders, ensuring a more relevant, reliable, and appealing transportation system.

FINANCIAL RESOURCES

The MTP must consider available revenue expected over the course of its horizon. Federal regulations require that projects listed in the plan to be matched with existing revenue sources or those forecast. This means the plan is constrained by already defined fiscal resources. Projects that fall outside this fiscal constraint will need a new revenue source, or an increase of existing sources, to be completed during this planning window (illustrative projects).

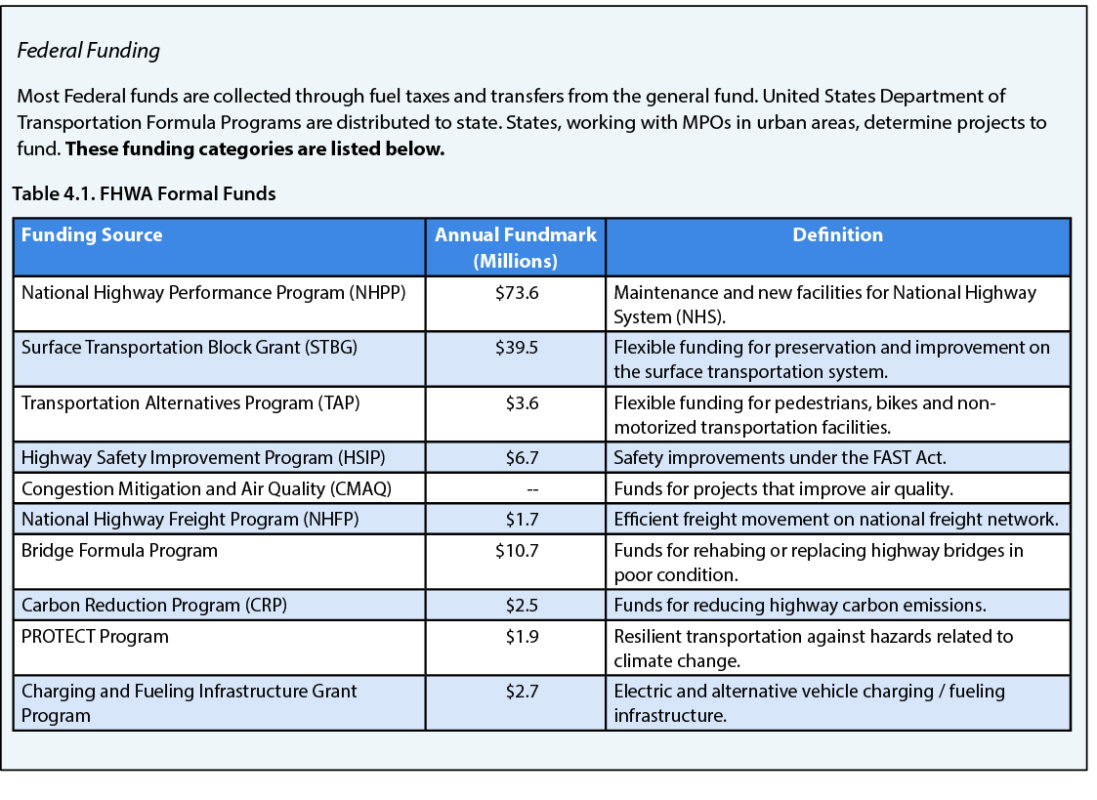

Funding Sources

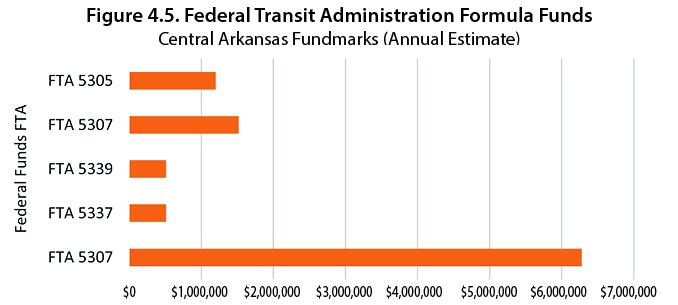

Transportation funding for projects in the Central Arkansas Regional Transportation Study (CARTS) are a mix of federal, state, and local sources. Estimates in the MTP are based on federal fund marks provided by the Arkansas Department of Transportation, local infrastructure budgets, and local transit funds. Fundmarks represent the average amount of funds the region is expected to receive, with individual amounts varying from year to year.

Impactful Revenue Trends

Fuel efficiency standards:

Corporate Average Fuel Economy (CAFÉ) standards govern fuel efficiency of all vehicles sold in the United States. In 2022, an industry-wide fleet average of approximately 49 mpg was adopted for passenger cars and light trucks for model year 2026, a 36% fuel-efficiency increase over year 2023*. While this is beneficial for energy conservation and the environment, it presents challenges for transportation revenue. Fuel taxes are collected on a per-gallon basis. Increased fuel efficiency means fewer gallons consumed, and therefore less revenue.

*https://www.nhtsa.gov/laws-regulations/corporate-average-fuel-economy#:~:text=The%20final%20rule%20establishes%20standards,annually%20for%20model%20year%202026.

30-Year Revenue Projections

The Bipartisan Infrastructure Law (BIL) alleviated federal transportation spending concerns for several years to come.

Despite the BIL, revenue will not keep pace with the growing list of needed and desired investments as transportation costs rise. The plan must be judicious in choosing projects that best meet our diverse needs while maintaining the current system. A 2% annual growth in revenue is assumed for federal funding sources, state fuel taxes, and a local turnback from fuel taxes. All other revenue sources use a 2.5% annual growth

Electric Vehicles

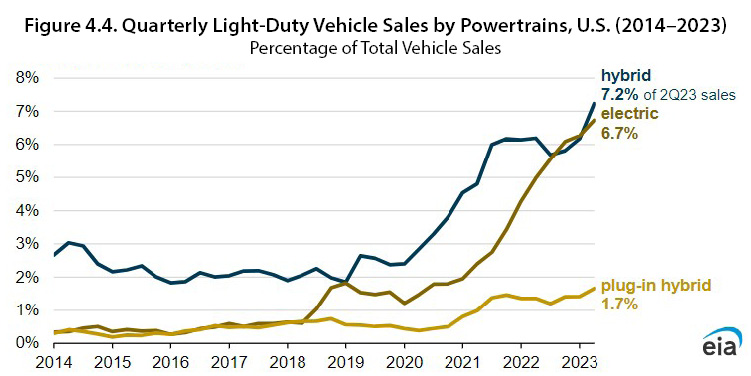

Electric vehicles are jolting into popularity. Manufacturers are ramping up production and customers are lining up for the promise of cleaner, more economical personal vehicles. Recent legislation has incentivized charging infrastructure investments across our freeway system. EV sales, including hybrids, accounted for 15% of sales in quarter 2 of 2023 according to the US Energy Information Administration.

Policy, however, has been playing catch up with EVs’ rising star. Given the reliance on fuel tax to fund transportation infrastructure, a rise in EV use will undoubtedly create funding shortfalls. Without new policy it may be hard to predict revenue trends in the future. New policies supporting and investing in an electrified mass transit fleet can help deliver the environmental benefits of EVs while accounting for revenue impacts.

Project Selection

The prioritization strategy endorsed by Metroplan is a relatively simple one: (1) cover our existing obligations, (2) maintain what we have already built, (3) optimize our existing networks through strategic investments and system efficiency projects, and (4) identify new revenue sources for major new projects.

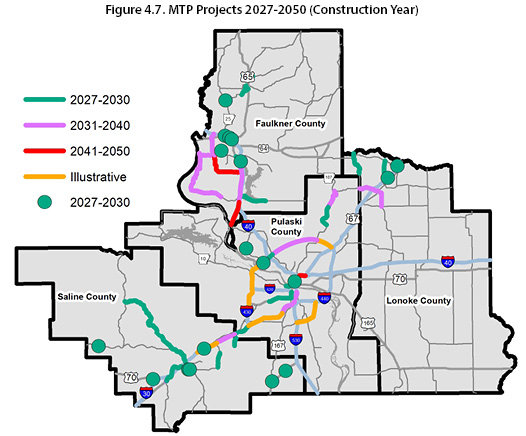

The following sections describe this strategy in more detail. Individual projects are listed in Table 4-a and shown in Figure 4-b.

Projects in the MTP are selected as follows.

1. Committed Projects

A number of project commitments were generated prior to the development of the MTP. These are projects that are already “in the pipeline” and should be followed through to completion. They are included in the financially constrained long-range transportation plan.

These include:

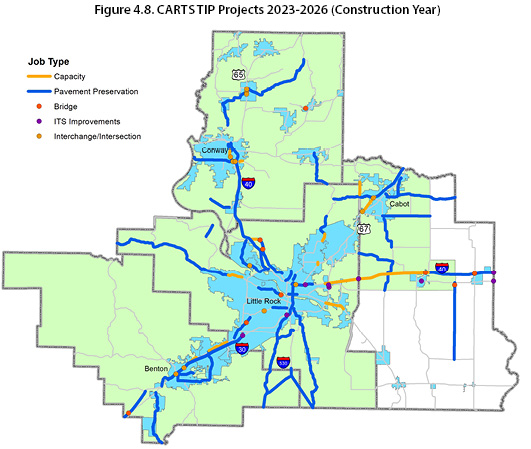

The 2023–2026 Transportation Improvement Program (TIP): Projects identified in the 2023-2026 TIP are considered part of this first priority.

Connecting Arkansas Program (CAP) Projects—Phase II: The CAP program identifies specific projects for the CARTS area to be funded with anticipated revenues generated by the state-wide half-cent sales tax.

Regional Greenways Projects: The Metroplan Board has targeted $55 Million for the implementation of the Regional Greenways plan.

Connecting Arkansas Program

The CAP program is a half-cent statewide sales tax for highway transportation projects. Set to expire in 2022, it was renewed as a permanent tax by voters in 2020 and took effect in June 2023. This pot of funding is not a direct allocation to Metroplan. However, it can be utilized on highway projects in the MTP in coordination with state plans.

2. Safety Projects and Maintaining Existing Network Through 2050

Central Arkansas has a significant amount of transportation infrastructure that must be maintained to be kept in good, working order. This includes routine maintenance and major rehabilitation needs of our interstates, arterials, and collectors, plus maintaining existing transit service. This category also applies to projects that have been identified for safety improvements.

3. Strategic Investments and System Efficiency Projects

Given the significant gap that exists between maintenance needs and available revenue, new project commitments should focus on projects that optimize the existing transportation network and critical network projects. Critical projects that are a priority of the Metroplan Board are included in the first 10 years of the constrained project list. Additional projects may also be selected during the TIP development process using the non-project specific funding line of

the MTP.

4. New Revenue Potential/Illustrative Projects

After funding the first three categories, there is limited existing funding is available for major Central Arkansas widening and new projects. These costly extensive projects will focus on partnering projects and new revenue sources.

Accounting for Inflation

Project costs are required to match revenue projections for the year that they are expected to start. For financial constraint, the plan must consider inflation by the year of expenditure. A 3% annual inflation rate is assumed for construction projects to the year 2050.

Hard to predict factors such as international disruptions, supply chain issues, or global pandemic may increase construction costs further. Although these do not affect projected revenue, they have a chilling effect on purchasing power. These trends will be assessed periodically throughout the plan horizon to adjust project starts as needed.

Metroplan Strategic Project List

Metroplan maintains a list of projects that will be pursued during the plan’s horizon, in this case, through year 2050. The list is fiscally constrained. This means that the total estimated expenditures on these projects do not exceed the expected revenues to the year 2050. Illustrative projects are projects above the current estimated revenues and would require new or increased funding.

The first four years of projects are included in the Transportation Improvement Program (TIP) 2023 through 2026 window. These projects have already been identified as receiving funding and have been given a let year. Beyond 2026, projects and their cost estimates are included, but funds have not yet been allocated and the projects are not given a let year. During the TIP and STIP development period these projects will be considered for inclusion in future TIPs. The list also includes variable funding categories for maintenance of the transportation system and other projects that will be considered as part of TIP development. See Table 4.8. below.

View Table 4.8. as pdf printable pages.

View Table 4.8. as 2-page pdf spreads.

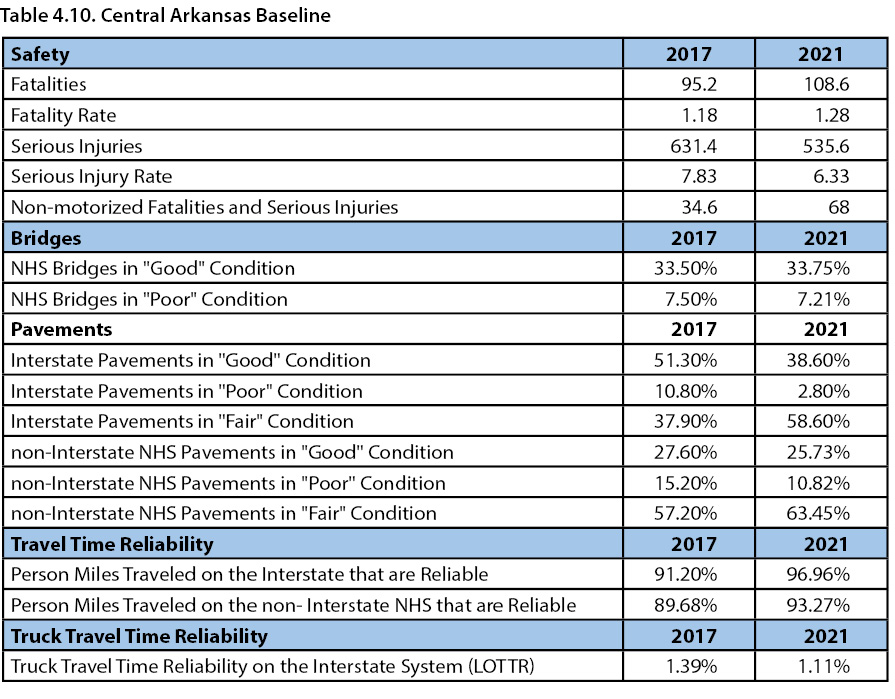

CENTRAL ARKANSAS PERFORMANCE MEASURES

Since 2012, Federal Law requires states and MPOs to maintain performance-based decision making for their transportation plans, specifically for Federal-Aid Highway Program funded projects. Metroplan’s full report on performance measures can be found in Appendix A. The BIL continues this tradition.

The law establishes seven goal areas:

- Safety

- Infrastructure Condition

- Congestion Reduction

- System Reliability

- Freight Movement and Economic Vitality

- Environmental Sustainability

- Reduced Project Delivery Delays

Performance measures must include data for pavement condition on the Interstate System and National Highway System (NHS), bridge condition, the number and rate of fatalities and serious injuries on all public roads, traffic congestion, and freight movement on the Interstate System. Data are collected and reported as an accumulative target over a period of 4 years.

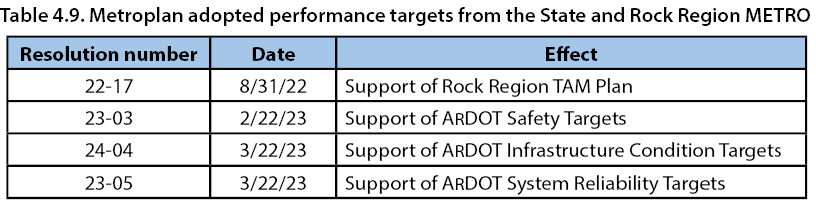

Currently, Metroplan opts to support targets set by ARDOT but could create specific targets for Central Arkansas in the future. In addition, Metroplan supports Rock Region METRO’s Transit Asset Management Plan (TAM) and its associated performance measures. Table 4.9 displays baseline data for the performance areas within the CARTS region.